![[sort:pic]](/template/default/images/banner/3-3.jpg)

Lean management provides customers with high-quality services and a visible panoramic view of the prosperous era.

Share

As the end of the year approaches, a surge in freight volumes is driving up container shipping rates on the trans-Pacific routes to the U.S., with further increases possible before the Chinese New Year. Additionally, from January 1, 2025, the Panama Canal Authority (ACP) will revise its transit booking system, prompting major carriers to impose new surcharges for Asia to U.S. East Coast shipments via the Panama Canal.

Sea Freight Rates – Baltic Freight Index (FBX):

• Asia to U.S. West Coast (FBX01 Weekly) +4% to $4,452/FEU

• Asia to U.S. East Coast (FBX03 Weekly) +2% to $5,932/FEU

• Asia to Northern Europe (FBX11 Weekly) -2% to $4,971/FEU

• Asia to Mediterranean (FBX13 Weekly) -1% to $5,721/FEU

Air Freight Rates – Freightos Air Index:

• China to North America Weekly -19% to $5.86/kg

• China to Northern Europe Weekly +40% to $4.92/kg

• Northern Europe to North America Weekly -9% to $2.75/kg

Trans-Pacific Routes:

Rates on trans-Pacific routes have risen by approximately 15% since early December, driven by the successful mid-month General Rate Increases (GRIs). Shippers are rushing to move goods ahead of potential tariff hikes under the U.S. administration, pushing rates higher and keeping vessels full. Carriers anticipate further GRIs before the Chinese New Year, potentially ranging from $1,000 to $3,000 per FEU. Despite strong volumes and tight rail capacity, U.S. ports remain operationally stable, ready to handle increased cargo.

Trans-Atlantic Routes:

Rates have remained stable since mid-October but could rise in January as some carriers, including MSC, plan to impose a $2,000/FEU congestion surcharge from January 18 to counter potential labor disruptions at ILA ports. The upcoming alliance reshuffling in February is also expected to cause temporary disruptions.

Asia-Europe and Mediterranean Routes:

Rates on these lanes have declined 3% to 7% since early December. Despite weather disruptions causing moderate congestion at major European hubs, mid-December rate hikes have not materialized significantly. However, the ongoing Red Sea rerouting remains a major cost driver, keeping rates at least double last year's levels.

California's Port of Long Beach has broken container volume records for six consecutive months, with November 2024 volumes reaching 884,154 TEUs, up 20.9% year-over-year and 12.8% higher than the previous record set in November 2020. The port is on track to handle 9.6 million TEUs in 2024, surpassing its pandemic-era peak.

Year-to-Date (First 11 Months) Data:

• Total Volume: 8,788,718 TEUs (+20.2%)

• Import Containers: 4,316,676 TEUs (+24.4%)

• Export Containers: 1,106,244 TEUs (-6.2%)

• Outbound Empty Containers: 3,209,206 TEUs (+28.7%)

• Inbound Empty Containers: 156,593 TEUs (-5.3%)

Port CEO Mario Cordero attributed this growth to strong consumer demand and strategic cargo rerouting by retailers avoiding potential labor disputes at East Coast and Gulf Coast ports.

From January 1, 2025, the ACP will revise its transit booking fees, including a 250% surcharge for late arrivals within 7 days of scheduled transit. In response, MSC and CMA CGM have announced new surcharges for Asia to U.S. East Coast shipments via the Panama Canal:

New Surcharge Details:

• Effective Date: January 1, 2025

• Rate: $40 per TEU

• Coverage: All cargo from Asia to U.S. East Coast and Gulf Coast

The ACP stated that these changes aim to "enhance service quality, reflect the value of booking services, and optimize operational efficiency."

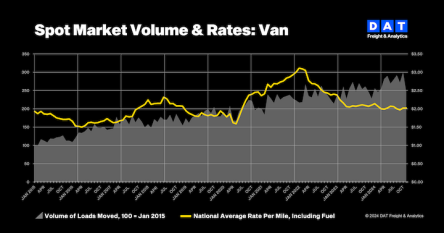

According to DAT Freight & Analytics, U.S. spot truckload volumes fell in November, marking the lowest levels since January 2024, as shippers front-loaded cargo earlier this year.

Key TVI Data:

• Van TVI: 246 (-18%)

• Reefer TVI: 204 (-11%, but +7% YoY)

• Flatbed TVI: 242 (-23%)

To support businesses ahead of the pre-Chinese New Year shipping surge, Century Logistics offers:

• Flexible Capacity Management: To ensure timely exports despite vessel space constraints.

• Cost Management Solutions: To counter rising freight rates and new surcharges.

• Supply Chain Risk Mitigation: Advanced tracking and data systems to reduce port congestion and delay risks.

With a global logistics network, Century Logistics is ready to help clients navigate peak season challenges and optimize their supply chains.