![[sort:pic]](/template/default/images/banner/3-3.jpg)

Lean management provides customers with high-quality services and a visible panoramic view of the prosperous era.

Share

Strike Looms as Trump Backs Unions; Shipping Firms Prepare Contingencies

Introduction:

Ports are vital to global trade, and any disruption could have far-reaching economic consequences. With the ILA-USMX negotiations at a critical juncture, former President Donald Trump has aligned himself with labor unions on port automation. As deadlines approach, the outcome of these talks may significantly impact U.S. supply chains and economic growth.

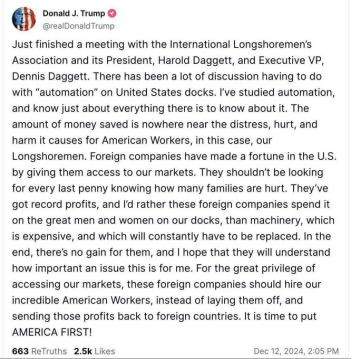

Former President Donald Trump has publicly supported the International Longshoremen's Association (ILA) in its negotiations with employers over port automation. Following a meeting with ILA President Harold Daggett, Trump declared on Truth Social that foreign operators at East and Gulf Coast ports should prioritize hiring American workers over investing in automation.

"I’ve studied automation and know almost everything about it. The savings [from automation] are far outweighed by the pain, suffering, and damage it inflicts on American workers—our longshoremen," Trump wrote. He urged foreign companies to reinvest profits into U.S. wages rather than costly, rapidly obsolete machinery.

Talks between the ILA and the United States Maritime Alliance (USMX), representing 45,000 workers across 36 ports, have stalled over the union’s refusal to permit semi-automated cranes, citing job loss concerns. A new agreement must be reached by January 15, 2025, or another strike could follow. A three-day strike in October halted billions in daily cargo operations until Biden administration intervention.

Employers argue automation enhances port capacity, creates jobs, and improves supply chain efficiency. Trump, however, criticized foreign firms for prioritizing automation over American labor, aligning with his "America First" agenda.

Despite tensions, the U.S. Gulf Maritime Association expressed willingness to collaborate with Trump’s administration on balancing worker safety, port efficiency, and job creation through technology.

Following Trump’s pro-union stance, the American Apparel & Footwear Association (AAFA) called for urgent labor talks. AAFA CEO Steve Lamar stressed the need for a "fair and equitable contract" by January 15, warning that a strike could cost $4.5–7.5 billion weekly, disrupt critical imports (e.g., pharmaceuticals), and exacerbate inflation.

The International Air Transport Association (IATA) forecasts air cargo demand growth to halve in 2025 (5.8% vs. 2024’s 12%), though airlines may still benefit from:

• Ongoing sea freight delays

• Tight cargo aircraft capacity

• Cross-border e-commerce growth

Risks Ahead:

• Potential U.S.-China trade wars under Trump’s tariff threats

• Red Sea shipping disruptions narrowing air-sea price gaps (airfreight now 5x pricier vs. pre-pandemic 10–15x)

• Port strikes driving demand for air logistics alternatives

With strike risks escalating, shipping firms like CMA CGM are activating contingency plans. Grandeur Global Logistics recommends:

Activate warehousing in Los Angeles, New York, or Houston (400,000 sq. ft. total) to buffer against delays.

Optimize costs amid volatile freight rates and reroute cargo to alternative ports if needed.

Leverage our:

• U.S.-Canada customs clearance network

• Real-time GPS tracking

• AI-driven fleet coordination to minimize delays

Prepare Now

Upcoming challenges—strikes, tariff rushes, alliance realignments—demand agility. Partner with Shengshi Global Logistics to secure capacity, mitigate risks, and thrive in a volatile market.

Shengshi Group – Your Partner in Navigating Supply Chain Uncertainty