![[sort:pic]](/template/default/images/banner/3-3.jpg)

Lean management provides customers with high-quality services and a visible panoramic view of the prosperous era.

Share

U.S. Port Congestion Worsens! 2025 Trade Policy Shifts Demand Proactive Strategies

Recent U.S. trade policy shifts and dockworker strikes are reshaping logistics for exporters, freight carriers, and cross-border e-commerce. Businesses must adapt now to mitigate risks and capitalize on emerging trends.

New projections reveal a container import boom at U.S. ports in 2025, driven by:

• Preemptive shipping to avoid potential East/Gulf Coast strikes.

• Tariff hedging ahead of Trump’s expected import levies.

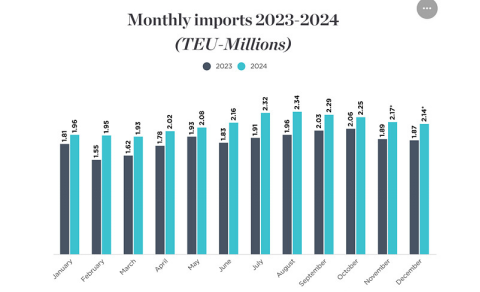

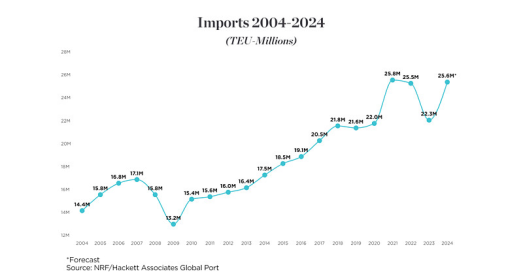

Key Data (NRF & Hackett Associates):

• October 2024: 2.25M TEU handled (-1.2% MoM, +9.3% YoY).

• 2024 Full-Year Forecast: 25.6M TEU (+14.8% YoY).

• Weekly Rail Records: November saw three all-time highs in intermodal container volumes.

Jonathan Gold, NRF VP of Supply Chain:

“Strikes or tariffs could derail the economy. Retailers are stockpiling early to cushion impacts on consumers and businesses. We urge port employers and the Trump administration to prioritize negotiations and targeted tariff strategies over blanket measures.”

• Section 321 Exemption Eliminated: Low-value (<$800) direct-to-consumer shipments from China (e.g., Shein, Temu) will face full tariffs.

• Effective Date: Late February/March 2025.

• Impact: Brands using Mexico/Canada transshipment loopholes will lose cost advantages.

• Congressional Proposal: $2 fee per customs-cleared item, atop standard tariffs.

• Hit Hardest: Direct-from-China sellers and 3PLs routing via Mexico/Canada.

• Peter Navarro’s Role: Trump’s trade advisor revival signals 10% baseline tariffs on Chinese goods by early 2025.

• Action Item: Stockpile inventory preemptively.

• Kash Patel’s Focus: Heightened scrutiny on Chinese tech platforms (e.g., TikTok, Temu) over data security risks.

✅ 50+ Years of Customs Expertise: Self-operated team with green card holders streamlines clearance.

✅ Smart Fleet Management: Real-time GPS tracking, AI-optimized routing, and 40% faster turnaround.

🔹 400K Sq. Ft Warehouses: Strategic hubs in LA, NYC, Houston for rapid replenishment.

🔹 Duty Deferral: Bonded storage to delay tariffs until goods sell.

• Multi-Modal Options: Air, rail, and trucking to bypass strikes.

• Emergency Clearance: 24/7 port pickup and cross-docking services.

With strikes lingering and tariffs looming, Shengshi’s end-to-end solutions ensure agility in turbulent times. From seamless customs clearance to AI-driven logistics, we empower businesses to:

• Avoid new fees with pre-tariff stockpiling.

• Slash costs via U.S. warehousing and bonded storage.

• Maintain delivery timelines despite port chaos.

Contact Shengshi Group today to turn 2025’s challenges into competitive advantages!