![[sort:pic]](/template/default/images/banner/3-3.jpg)

Lean management provides customers with high-quality services and a visible panoramic view of the prosperous era.

Share

East Coast Ports Reach Preliminary Labor Agreement; Trucking Market Shows Recovery Signs; U.S. Customs Intensifies Enforcement

ILA and USMX Strike Automation Deal, Averting Port Strike

The International Longshoremen’s Association (ILA) and the United States Maritime Alliance (USMX) have reached a tentative six-year master contract agreement, covering dozens of ports and freight hubs from Texas to New England and affecting approximately 45,000 union workers. The deal replaces the existing contract extended after a brief October 2024 strike, originally set to expire on January 15, 2025.

Key Details:

• Compromise Highlights: Terminal operators gain flexibility to introduce semi-automated rail-mounted gantry cranes to boost efficiency, while the union secures new high-wage jobs tied to the equipment.

• Approval Timeline: Final details remain confidential pending ratification, expected through summer 2025.

• Political Context: The agreement aligns with the start of President-elect Donald Trump’s potential second term. Trump previously voiced support for union opposition to automation.

Spot container rates for the eastbound Trans-Pacific trade opened 2025 with robust growth, driven by January 1 General Rate Increases (GRIs) and surging U.S. import demand.

Rate Trends (Drewry WCI Index):

• Shanghai to Los Angeles: $4,829 per 40ft, up 7% WoW and 77% YoY.

• Shanghai to New York: $6,445 per 40ft, up 6% WoW and 67% YoY.

• Trans-Atlantic Stability: Rotterdam-New York rates held at $2,720 per 40ft, up 81% YoY.

Carrier Actions:

• CMA CGM announced 1,500 PSS for Middle East/Indian Subcontinent cargo (effective Jan 15).

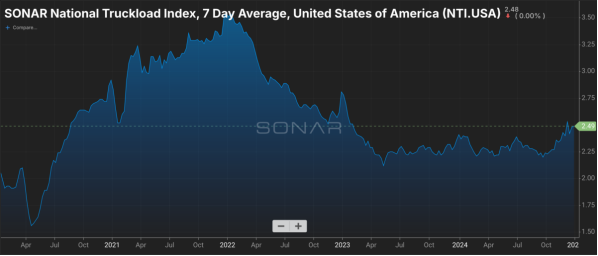

After nearly three years of downturn, the trucking sector shows early signs of recovery, prompting Susquehanna analyst Bascome Majors to upgrade multiple stocks.

Upgraded Ratings & Targets:

• Knight-Swift (KNX): Positive, $67 target (+27% upside).

• JB Hunt (JBHT): Positive, $200 target (+17%).

• Hub Group (HUBG): Positive, $55 target (+25%).

• CH Robinson (CHRW): Positive, $130 target (+26%).

• Werner (WERN): Neutral, $38 target (+7%).

Recovery Drivers:

• Stabilizing truckload capacity, retail spending, and industrial production.

• Modest Class 8 tractor sales growth and improved bid rejection rates.

U.S. Customs and Border Protection (CBP) seized four shipments in Louisville containing 962 counterfeit luxury items (Rolex watches, Cartier bracelets, etc.) with a total MSRP exceeding $18.8 million.

Key Risks for Importers:

• Delays: Increased inspections prolong clearance times.

• Penalties: Fines, confiscations, or criminal charges for non-compliance.

• Supply Chain Disruptions: Unplanned costs and operational halts.

Compliance Tips:

• Avoid mixing sensitive items (liquids, powders, etc.) in shipments.

• Ensure accurate product descriptions and certifications.

• Partner with experienced logistics providers.

• U.S. Focus: Children’s products (toys, apparel), electronics, automotive goods.

• EU Focus: Labeling compliance, low-value declaration checks, and product standards (e.g., textiles, lighting).

Services to Mitigate Risks:

⒈ Expert Clearance: Licensed customs brokers ensure precise tariff classification and multi-agency compliance.

⒉ Preemptive Planning: Leverage U.S. warehouses to buffer against delays and maintain inventory flow.

⒊ Optimized Packaging: Clear labeling and compliant designs to expedite inspections.

⒋ U.S. Network: 300+ trailers, 400K sq.ft of warehouse space across major hubs (LA, NYC, Houston, etc.).

Global Support: With offices in China, Shengshi provides end-to-end logistics solutions for cross-border businesses.