![[sort:pic]](/template/default/images/banner/3-3.jpg)

Lean management provides customers with high-quality services and a visible panoramic view of the prosperous era.

Share

Introduction

On Wednesday (July 2nd), Donald Trump announced via his social media platform that the United States and Vietnam have formally reached a new trade agreement. Specifically: U.S. tariffs on Vietnamese export goods will be reduced from 46% to 20%. Simultaneously, a tariff as high as 40% will be imposed on goods from third countries transshipped through Vietnam.

According to the agreement, the U.S. will impose a 20% tariff on all goods exported from Vietnam, replacing the previously planned 46% high tariff scheduled for April.

Effective Date: July 9, 2025

This rate covers Vietnam's main export categories, including textiles, electronic components, and aquatic products.

For goods identified as "transshipments" (i.e., components originating from third countries like China, undergoing only simple processing or transshipment in Vietnam), a 40% tariff will be levied. This aims to combat efforts to circumvent tariffs on Chinese goods.

The specific list of transshipment goods has not yet been published, and the enforcement criteria remain ambiguous, potentially leading to future disputes.

Vietnam's Commitments:

1.Implement zero tariffs on U.S. goods, covering agricultural products (poultry, pork, beef) and certain industrial goods.

2.Procure an additional $8 billion worth of Boeing aircraft and fulfill a $2.9 billion agricultural product purchase agreement.

• Trade Imbalance Driver: Vietnam's trade surplus with the U.S. reached $123.5 billion in 2024, ranking third globally, sparking U.S. dissatisfaction.

• Alternative China Supply Chain Issue: In recent years, companies moved production lines to Vietnam to avoid tariffs on China, causing a surge in Vietnamese exports to the U.S. (reaching $137 billion in 2024, accounting for 30% of its total exports). The U.S. aims to close this "backdoor."

April 2025: The U.S. announced a 46% tariff on 90% of Vietnamese goods but set a 90-day suspension period (maintaining a 10% rate).

July 2025: Trump announced the new agreement, with the 20% tariff taking effect on July 9th after the suspension period ends.

1.Ambiguous Definition of Transshipment:

Business consultant Dan Martin noted that "transshipment" is a politicized term in trade enforcement. How the standard for "last substantial transformation" is defined (e.g., whether it includes substantive production stages) will impact the agreement's effectiveness.

2.Vietnam's Demands:

Vietnam requested the U.S. to recognize its "Market Economy Status" (reducing anti-dumping risks) and lift high-tech export restrictions. However, these did not receive a clear response from the U.S. side.

• Short-Term Shock: Although 20% is lower than 46%, it still squeezes corporate profits. Had 46% been implemented, Vietnam's GDP could have lost 5%, with orders decreasing by 20-35%.

• Long-Term Strategy:

▪ Accelerate signing a free trade agreement with the EU (aiming for zero tariffs on 99% of goods) to diversify market risks.

▪ Promote industrial chain upgrades, reducing reliance on transshipment trade.

▪ Increased Business Costs: Brands reliant on Vietnamese production like Nike and Lululemon face cost pressures. However, the market reacted optimistically due to Vietnam opening its market to U.S. goods, leading to rising stock prices for related U.S. companies.

▪ Inflation Risk: Rising manufacturing costs in Vietnam could push up global commodity prices, exacerbating inflationary pressures.

▪ Supply Chain Restructuring: Some companies may shift production capacity to countries like Indonesia or Mexico, but Vietnam remains attractive due to its established industrial chain completeness.

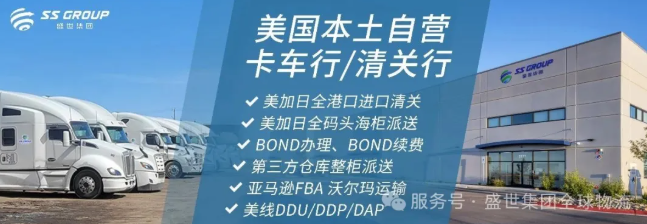

Amidst the current volatile tariff landscape, SSR GROUP is committed to being your steadfast partner, standing shoulder-to-shoulder with you.

SSR GROUP Global Logistics -- Specializing in US final-mile customs clearance & transshipment, Amazon FBA logistics, and third-party warehousing one-stop services. Headquartered in Los Angeles, we are a US-based customs brokerage firm with over 50 years of customs clearance experience and our own team of green card-holding Chinese customs clearance professionals. We have the latest news, firsthand information, and can help you avoid pitfalls to achieve comprehensive cross-border e-commerce business development.

In this challenging tariff environment, choosing us means choosing professionalism, efficiency, and peace of mind. SSR GROUP will spare no effort, using our expertise to safeguard your cargo, helping you navigate steadily through the complex and ever-changing international trade market. Together, we will overcome difficulties and expand broader business horizons!