![[sort:pic]](/template/default/images/banner/3-3.jpg)

Lean management provides customers with high-quality services and a visible panoramic view of the prosperous era.

Share

As the July 9, 2025 deadline for former President Trump’s global tariff overhaul approaches, the U.S. has intensified enforcement under Section 232. A new directive mandates a 200% punitive tariff on derivative aluminum products with unidentified countries of smelt or cast. This rule takes effect on June 28, 2025, creating significant pressure on businesses relying on Chinese and other low-cost aluminum imports.

Effective June 28, 2025, importers of derivative aluminum products must declare:

- The ISO country code of both the country of smelt and country of cast;

- If unknown, “UN” must be entered;

- Products will be classified under HTS 9903.85.67 or 9903.85.68;

- Missing or incorrect data will trigger ACE system errors (856 or 60B) and entry denial.

If the origin is listed as “UN,” a default 200% tariff under Section 232 will apply — a rate previously reserved for Russian aluminum.

Not traditional raw materials, but downstream aluminum components, including:

- Aluminum foil pouches and can lids;

- Internal aluminum parts in home appliances;

- Fasteners, brackets in automotive, electronics, and motor industries.

China, as the world’s largest aluminum processor/exporter, will be deeply affected — especially OEMs, private label exporters, and cross-border e-commerce sellers.

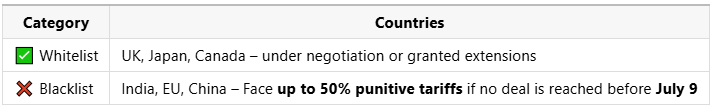

Current Negotiation Status:

✅ UK: Partial deal reached, tariffs reduced;

❌ EU: Talks stalled;

❌ China: Silent, but retaliation list reportedly prepared.

Special Terms Secured:

- Aerospace tariffs → 0% (previously 5–15%)

- 100,000 UK vehicles → 10% tariff (down from 27.5%)

- Beef import quota → 13,000 tons duty-free

Hidden Cost:

Steel and aluminum tariffs of 25% remain, impacting $1.2B annual exports.

- Mexico nearshoring boom: Q1 2025 FDI ↑ 165%

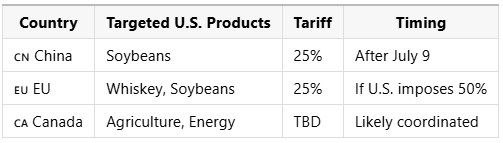

- China/EU/Canada planning retaliatory duties on U.S. agriculture/energy exports post-July 9

- Retail sector hit hard: Hasbro to cut 3% workforce, citing higher toy tariffs from China

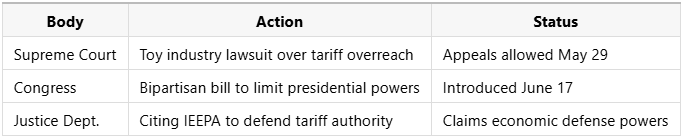

Legal Forecast:

If the Supreme Court hears the case in July, it may undermine the legal foundation of Trump’s tariff regime.

1. Trace Product Origins Immediately

- Request smelt/cast origin documentation from suppliers

- Convert origin data into ISO codes to avoid misclassification

2. Avoid Using “UN”

- Automatically triggers 200% tariff

- Increases customs rejection risk and operational cost

3. Re-evaluate Tariff Pass-Through & Product Strategy

- Consider FOB/Mexico shipping options

- Model cost impact across product lines under potential tariffs

Trade policy is changing rapidly. July 9 could be the turning point. Act now to stay ahead!

SSR GROUP – Qingdao Shengshi Tongzhou International Logistics

We offer:

- Professional customs risk analysis

- Standardized Certificate of Origin templates

- Dispute resolution and U.S. customs brokerage support

“The tariff tsunami from the White House is rewriting corporate destinies.

Some are laying off staff, some are relocating factories overnight,

others are gambling everything on negotiations.

In the eye of the storm, the clock ticks — and July 9 draws near.”