![[sort:pic]](/template/default/images/banner/3-3.jpg)

Lean management provides customers with high-quality services and a visible panoramic view of the prosperous era.

Share

Will the U.S. Sever China’s Shipping Dominance? Details of "Sky-High Port Fees" Revealed—Where Will Global Trade Turn?

The U.S. Trade Representative (USTR) has finalized a new port policy set to take effect on October 14, 2025, imposing staggering port fees on Chinese vessels and restricting liquefied natural gas (LNG) carrier operations. This move, an extension of the U.S. "Section 301 investigation," targets China’s overwhelming dominance in global shipping.

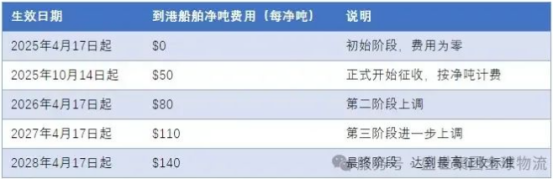

Policy Details

⒈ Chinese Vessel Operators & Owners

• **50/netton**(≈¥365),up from 0 previously.

• Annual increase of 30 / netton * * ,reaching ** 140 / net ton (≈ ¥ 1022)by 2028.

• Annual port call cap : 5 stops per vessel.

• Fee ceiling: Up to $1 million per U.S. port call.

Case Study:

COSCO’s THAILAND (59,000 net tons) faces 2.95milionpercall* *(≈ ¥21.5million).By2028, fiveannualcallswouldcost* *41.3 million (≈¥300 million) - 15% of the vessel’s construction cost.

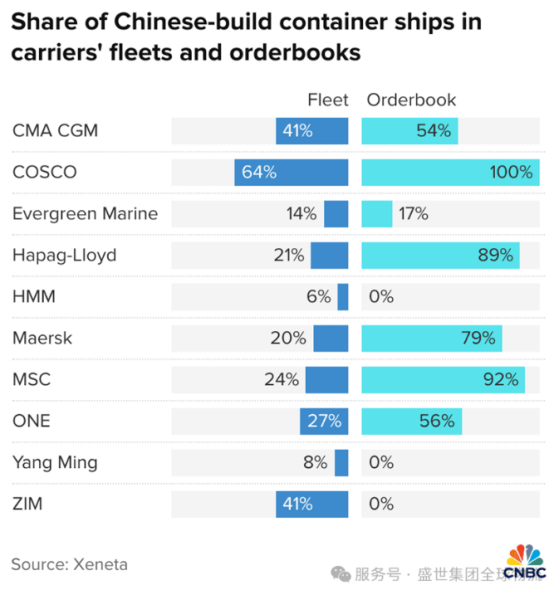

⒉ Operators with Chinese-built Vessels

• Fees: 18/netton * *or **120/container (whichever is higher), escalating yearly.

• Exemptions: Empty vessels, U.S. Maritime Security Program (MSP) ships, short-haul vessels.

• Incentives: 3-year fee pause for ordering U.S.-built ships.

• Fee ceiling: Up to $1.5 million per call, based on Chinese-built vessel share in fleets.

⒊ From LNG to Data Blockades

• LNG Exports: 15% must be transported on U.s. ships by 2028, rising to0100% by 2047.

• Tariff Hikes:

▫ "STS cranes: 100% tariff (up from 50%)

▫ Loading equipment: 20-100% tariffs.

• Data Restrictions: Block China's LOGlNK platform from U.s. ports toprevent "data infiltration.

U.S. "Balancing Act" vs. Global Realities

China’s Shipping Supremacy:

• Builds 1 in 2 new ships globally; holds 50%+ of global shipbuilding tonnage (up from 5% in 1999).

• Key Data:

▫ Shipbuilding: 74% global market share (U.S.: 0.2%).

▫ Port cranes: 80% made in China (U.S.: 0%).

▫ Containers: 96% produced in China (U.S.: 100% imported).

180-Day Buffer & Political Calculus:

• Phase 1 (Apr.-Oct. 2025): 180-day fee-free window for adjustments.

• Phase 2 (Post-2028): Gradual restrictions to avoid supply chain collapse.

Divided Stakeholders:

✅ Supporters: Steelworkers’ unions, shipbuilding lobbies cheer "revival of U.S. industry."

❌ Opponents:

▫ National Retail Federation: "Fees will crush middle-class wallets."

▫ World Shipping Council: "Policy risks 2021-style port chaos."

Industry Shockwaves

⒈From Shipping Giants to Store Shelves

• Carriers: Mediterranean Shipping Co., Maersk avoiding U.S. ports could slash transpacific capacity by 30%, spiking global rates.

• Consumers: Peterson Institute predicts 5-8% price hikes for apparel and electronics.

⒉U.S. Shipbuilding "Not Ready"

• Cost Gap: U.S. shipbuilding costs 3-5x China’s(e.g., 2.3billionus.600million for an LNG carrier).

• Capacity Crisis: U.S. shipyards backlogged with 35 naval orders; civilian production near-zero.

• Workforce Crisis: Average U.S. shipyard worker age: 55.

⒊From Tariffs to "Port Wars"

• China's countermeasures:

▫ Restrict high-end steel exports for shipbuilding.

▫ Develop bypass hubs in Mexico/Southeast Asia (China-ASEAN shipping up 27%).

• Global Shift: RCEP members may emerge as new shipping hubs.

Reality Check

⒈Can the U.S. Deliver?

• Shipbuilding Revival? No skilled workforce, 90% steel imports, aging infrastructure.

• Alliance Risks: EU, Japan resist joining U.S.-China feud.

⒉China’s Counterplay

• Tech Breakthroughs: Challenge Korea’s LNG tanker dominance.

• Port Innovation: Promote "hub-and-spoke" models (e.g., Shenzhen-Singapore digital partnerships).

• Rulemaking: Partner with Brazil, Indonesia to reshape IMO pricing.

⒊Global Trade’s "Gray Rhino"

• SMEs at Risk: African coffee exporters, Yiwu manufacturers may exit U.S. markets.

• Green Shipping Stalls: U.S.-China tensions delay IMO’s 2050 net-zero goals.

The Costly Gamble

The U.S. crackdown exposes its industrial decline. Key stats:

• China’s orderbook: 54% of global ships (secured through 2028).

• U.S. reliance: 60% of East Coast cranes still maintained by Chinese firms.

Who Wins ?

• Short-term: Japanese/Korean shipyards gain orders.

• Long-term: U.S. consumers foot the bill for unworkable policies.

Shengshi Group: Your Partner in Turbulent Times

Amid escalating tariffs, Shengshi Group stands with you:

• Expertise: Green Card-holding Chinese-American customs team with decades of experience.

• Custom Solutions: Tailored strategies for tariff planning, document prep, and multi-agency compliance.

• Delay Prevention: Pre-clearance warehousing across 40,000 sq ft of U.S. hubs (LA, NYC, Houston).

• End-to-End Support: From customs to last-mile delivery, we streamline your supply chain.

Choose Shengshi to navigate trade storms and secure your global operations.