![[sort:pic]](/template/default/images/banner/3-3.jpg)

Lean management provides customers with high-quality services and a visible panoramic view of the prosperous era.

Share

U.S. Imposes 25% Tariff on Autos & Parts; LNG Trade Plummets; Shipping Rates Collapse

Escalating Auto Tariffs: U.S.-China Trade War Intensifies

President Trump signed an executive order on April 3 imposing a 25% tariff on all Chinese-made vehicles and auto parts, up from the previous 2.5%. Key details:

• Immediate Impact: Light trucks and critical components face the steepest hikes.

• Phased Implementation: Full 25% tariff on foreign-assembled U.S.-brand vehicles by May 3.

• Domestic Exemption: Auto manufacturers with U.S. production lines gain tariff waivers.

Market Shockwaves:

• $37B Chinese Auto Exports at Risk: U.S. car prices projected to rise 6-8% (Morgan Stanley).

• Global Supply Chain Disruption: German, Japanese, and Korean automakers scramble to restructure North American operations.

• WTO Violation Concerns: Experts warn the move breaches "most-favored-nation" principles, accelerating global supply chain decoupling.

China Halts U.S. LNG Imports: Energy Trade Freeze

Amid retaliatory tariffs, China has suspended U.S. LNG imports for 40+ days, redirecting 416,000 tons ($2.4B) to Europe. Key repercussions:

• U.S. Export Crisis: Cheniere Energy’s Corpus Christi Phase III and Venture Global’s $28B CP2 project face oversupply risks.

• Global LNG Market Shift: Qatar, Russia, and Malaysia emerge as China’s top suppliers, displacing the U.S. to 4th place.

Butterfly Effects:

• EU spot prices destabilized by redirected cargoes.

• Maersk suspends U.S.-China LNG routes; VLCC rates plunge 43% monthly (Singapore Exchange).

• U.S. Gulf Coast port storage fees surge 300%.

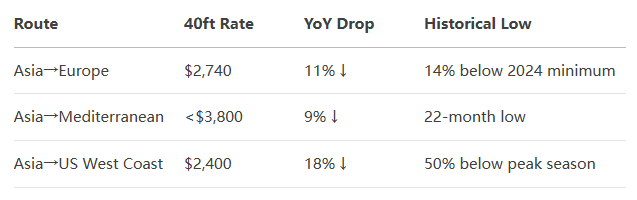

Shipping Market Meltdown: Freight Rates Hit Record Lows

Freightos Data (April 2024):

Triple Whammy:

⒈Post-Chinese New Year demand vacuum.

⒉Shipping alliance reshuffles disrupt capacity.

⒊2023’s 2M+ TEU new vessel deliveries flood the market.

Red Sea Ripple Fades:

• Pre-Lunar New Year cargo surge leaves warehouses 200% fuller YoY.

• Shanghai’s Waigaoqiao Terminal yard utilization drops to 68% (-35% vs. pre-holiday).

LA Port Hits Record Volume Amid Trade Tensions

February 2024 Highlights:

• Total Throughput: 801,398 TEU ▲2.5%

• Imports: 413,236 TEU ▲1% (retailers stockpiling for tariffs)

• Exports: 109,156 TEU ▼18% (structural trade deficit worsens)

• Empty Containers: 279,006 TEU ▲16% (shipment imbalances rise)

Behind the Boom:

• Retailers advance orders by 3-6 months to dodge tariffs.

• Southeast Asia siphons U.S. exports (Vietnam’s exports ▲19%).

Executive Warning:

LA Port Director Gene Seroka cautions a potential 10% H2 2025 volume drop due to inventory gluts and policy uncertainty.

U.S. Ship Fee Policy Sparks Export Chaos

A draft White House order imposes $1.5M/visit fees on China-built vessels, triggering:

• Coal Crisis: Xcoal CEO confirms $130B energy exports at risk; layoffs loom.

• Agriculture Collapse: Soy/corn exporters halt May futures; $64B trade paralyzed.

• LNG Export Dilemma: Zero U.S.-built LNG carriers threaten 12% global market share.

Reality Check:

• U.S. shipyards operate at <35% capacity; new vessels take 5-7 years to build.

• Global 90% dry bulk fleet relies on Chinese shipbuilders.

Shengshi Group: Navigating Trade Turmoil

As tariffs and logistics chaos escalate, Shengshi Group delivers end-to-end solutions:

1. Customs Mastery:

• Licensed brokers ensure precise HS code classification and duty optimization.

• Tackle anti-dumping compliance and FDA/USDA pre-clearance.

2. Storage & Speed:

• 400,000 sq ft U.S. warehouses buffer delays; expedite post-clearance delivery.

• 300+ chassis nationwide for seamless drayage.

3. Cost Control:

• Duty drawback programs and bonded warehousing strategies.

• Real-time port congestion analytics (vessel wait times,仓储费 trends).

4. China-U.S. Coordination:

• On-ground teams in LA, NYC, Houston, and China streamline cross-border ops.

Act Now:

Leverage Shengshi’s 50+ years of expertise to secure your supply chain.

Turn trade risks into opportunities. Optimize compliance, cut costs, and stay agile.