![[sort:pic]](/template/default/images/banner/3-3.jpg)

Lean management provides customers with high-quality services and a visible panoramic view of the prosperous era.

Share

Trump Announces 25% Steel and Aluminum Tariffs, Threatens Reciprocal Levies Amid Policy Chaos

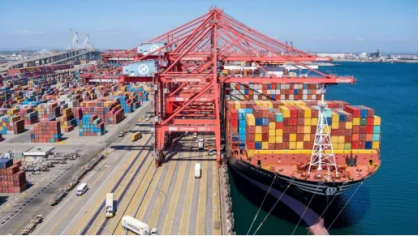

Abrupt Trade Rule Reversals Spark Backlash as Ports Face Gridlock

Trump Escalates Global Trade Wars with Sweeping Metal Tariffs

February 9 – Former President Donald Trump declared plans to impose a 25% tariff on all steel and aluminum imports, targeting all countries equally. Additional “reciprocal tariffs” mirroring other nations’ duties on U.S. goods will follow later this week, though implementation timelines remain unclear.

Key Impacts:

→ Canada & Mexico Hit Hardest: The U.S. imports 9 billion in aluminum annually from Canada alone.

→ Echoes of Trump 1.0: Similar 2018 tariffs (25% on steel, 10% on aluminum) triggered retaliatory measures from the EU, Canada, and others before exemptions were granted.

“Threaten First, Delay Later”: A Pattern of Policy Whiplash

Trump’s latest strategy leverages tariffs as a negotiation tool rather than an immediate economic weapon. On February 13, he vowed to enforce “reciprocal tariffs” to equalize U.S. and foreign trade terms, while threatening levies against countries using value-added tax (VAT) systems.

White House Statement:

“For fairness in trade, I will charge a reciprocal tax… Whatever a country charges us, we will charge them the same—no more, no less.”

Critics argue the approach prioritizes political theater over coherent policy, exemplified by the chaotic reversal of China’s de minimis exemption (see below).

Global Backlash: Allies Condemn “Economic Hostility”

• EU: “We will act to protect European interests from unjustified measures.”

• UK Steel Industry: “Tariffs would devastate our sector,” citing the U.S. as its second-largest export market.

• Canada’s Industry Minister: “Canadian steel supports U.S. defense and automotive sectors. We will defend our workers.”

Policy Chaos: “De Minimis” Reversal Exposes Systemic Dysfunction

February 1–7 Timeline:

⒈ Initial Crackdown: Trump revoked China’s $800 “de minimis” exemption (under Section 321 of the 1930 Tariff Act) to combat fentanyl smuggling.

⒉ Postal Service Freeze: USPS halted China-bound parcels on February 5, citing operational confusion.

⒊ Abrupt Reversal: By February 7, exemptions were reinstated after ports faced massive backlogs, admitting the U.S. lacks infrastructure to process tariffs on 1+ billion annual small parcels.

Critics Blast “Snap Decision” Governance:

• Rep. Rosa DeLauro (D-CT): “You can’t just snap your fingers… The administration failed to consult stakeholders or plan for implementation.”

• FedEx Influence Alleged: DeLauro accused Trump of caving to lobbying by FedEx, UPS, and DHL after a February 7 meeting with FedEx’s board.

• Industry Fallout: Kim Glas (NCTO) demanded a full de minimis ban, claiming it enables forced labor goods and has shuttered 27 U.S. factories since 2022.

China’s Response: “Trade Wars Have No Winners”

February 5 Foreign Ministry Statement:

• Spokesperson Lin Jian: “China strongly opposes the U.S. politicizing trade. Tariffs under the guise of fentanyl concerns are unacceptable.”

• On Parcel Rejections: “Stop weaponizing economic tools. China will defend its legitimate rights.”

Shippers Brace for Uncertainty: Rethink Contracts, Share Risks

Global Shippers Forum Advisory:

• James Hookham: “Carriers must share risks amid Red Sea chaos and Trump’s volatility. Traditional rate models won’t suffice.”

• Capacity Glut Warning: If Red Sea routes reopen, 70+ ships could sit idle, destabilizing spot markets.

Shengshi Logistics: Turning Tariff Chaos into Competitive Edge

Decades of Expertise in Crisis Navigation

Solutions for 2024’s Perfect Storm:

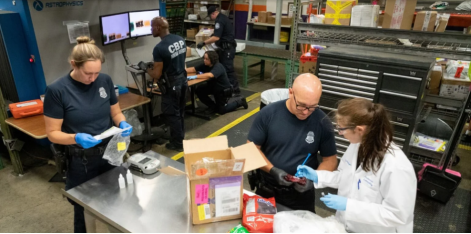

⒈ Lightning-Fast Clearance:

• Licensed customs brokers ensure precise HS coding, duty calculations, and multi-agency compliance (FDA, EPA, etc.).

⒉ Delay-Proof Warehousing:

• 400,000 sq. ft. of U.S. warehouses (LA, NYC, Houston, Chicago) enable rapid post-clearance delivery.

⒊ Nationwide Fleet Network:

• 300+ owned chassis and trailers guarantee seamless drayage from major ports.

⒋ China-U.S. Coordination:

• On-the-ground teams in Shanghai, Shenzhen, and Tokyo optimize cross-border workflows.

Proactive Compliance:

• Real-time CBP policy tracking and contingency planning for tariff shifts.

• AI-driven logistics platforms minimize costs amid volatile rates.

Why Shengshi ?

“In a world of snap decisions, we turn chaos into clarity—ensuring your goods move faster, smarter, and cheaper.”