![[sort:pic]](/template/default/images/banner/3-3.jpg)

Lean management provides customers with high-quality services and a visible panoramic view of the prosperous era.

Share

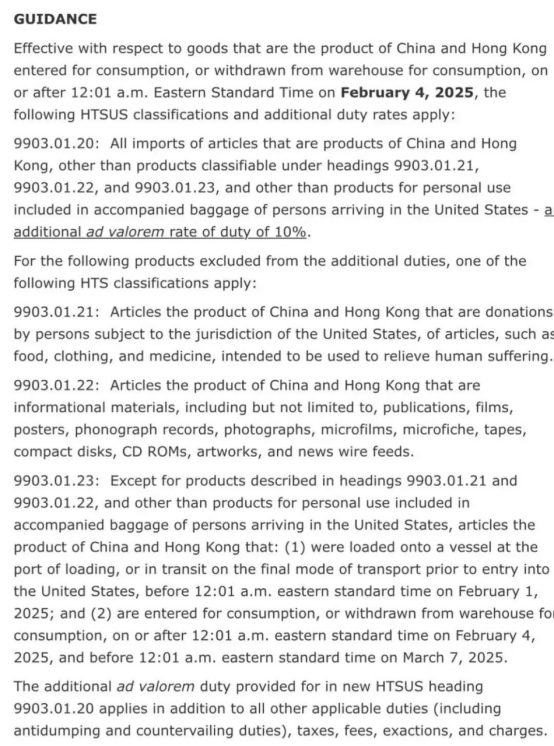

Final Interpretation & Notice: U.S. Imposes 10% Tariff on Chinese Imports

Effective Date & Scope

• Effective: February 4, 2025, at 12:01 AM EST.

• Applicability: All goods imported from China (including Hong Kong) will face a 10% ad valorem tariff, unless exempted.

• De Minimis Exemption Removed: Goods from China/Hong Kong no longer qualify for duty-free entry under the $800 de minimis threshold.

Exemption Criteria

Goods exempted if they meet the following HTS classifications:

⒈ 9903.01.21: Donated items for humanitarian relief (e.g., food, clothing, medicine).

⒉ 9903.01.22: Informational materials (books, films, artwork, CDs, etc.).

⒊ 9903.01.23: Goods meeting BOTH conditions:

• ETD (Estimated Departure) before February 1, 2025, AND

• Entry into U.S. consumption or withdrawn from warehouse by March 7, 2025.

Key Implementation Details

• Additional Costs: 10% tariff applies on top of existing duties (e.g., anti-dumping, countervailing duties).

• Foreign Trade Zones: Eligible goods must enter under “privileged foreign status” and pay tariffs.

• No Refunds: Tariffs are non-refundable.

• Documentation: Full formal entry declarations required for all shipments.

Impact on Cross-Border E-Commerce

1. Increased Costs

• Additional tariffs directly raise import costs, squeezing seller margins if not passed to consumers.

2. Complex Clearance Procedures

• Delays: Extended customs processing due to tariff verification and stricter checks.

• Documentation: Higher demand for origin certificates, commercial invoices, and compliance proofs.

• Delivery Risks: Longer lead times may harm customer satisfaction.

3. De Minimis Exemption Removal

• Small-value shipments (previously duty-free under $800) now require full tariff payments.

4. Logistics Adjustments

• Pre-Stocking: Shift inventory to U.S. warehouses to bypass delays (e.g., Shengshi’s 400,000 sq.ft network).

• Diversified Routing: Explore transshipment via third countries to mitigate tariff impacts.

Shengshi Group: Your Compliance Partner

1. Expedited Clearance for Exemptions

• Submit cargo manifests with ETD before February 1 and ensure arrival by March 7 to avoid tariffs.

• Leverage Shengshi’s real-time tracking and priority booking to secure shipping capacity.

2. U.S. Warehouse Pre-Stocking

• Store inventory in Shengshi’s hubs (LA, NYC, Houston) to:

• Avoid tariff-induced delays.

• Reduce last-mile costs and accelerate delivery.

3. Expert Customs Brokerage

• 50+ Years of Experience: Licensed Chinese-American team ensures accurate HTS classification, duty calculation, and multi-agency compliance.

• End-to-End Solutions: From document preparation to delivery, we streamline your supply chain.

Act Now to Mitigate Risks

Deadline Alert: Ensure shipments meet exemption timelines and optimize logistics strategies today.

Contact Shengshi Group:

Email: [contact@shengshigroup.com]

With Shengshi’s expertise, turn regulatory challenges into competitive advantages. Trust us to safeguard your cross-border success.