![[sort:pic]](/template/default/images/banner/3-3.jpg)

Lean management provides customers with high-quality services and a visible panoramic view of the prosperous era.

Share

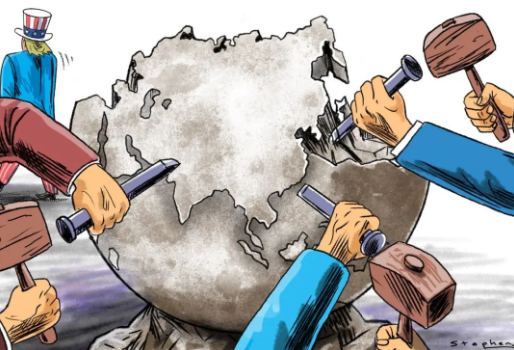

Eye of the Tariff Storm: Where Are Industries Heading? A Quick Look at Recent Global Tariff Developments

The U.S.-China trade war continues to escalate, pushing the global economy to the brink of recession. Neither side is willing to back down—the U.S. has raised tariffs and tightened tech restrictions on China, while China has retaliated in kind. Though both nations have incentives to negotiate, neither wants to make the first move, as any unilateral gesture risks being labeled as surrender.

Recent Tariff Developments (April)

United States

April 3: Imposed a 10% across-the-board tariff on all imported goods.

April 9: Announced a 104% tariff hike on Chinese imports.

April 10: Raised tariffs on Chinese goods to 125%.

April 15: Imposed 245% retaliatory tariffs on China.

China

April 4: Imposed a 34% tariff on all U.S.-origin goods.

April 9: Increased existing tariffs on U.S. goods from 34% to 84%.

April 11: Raised tariffs on U.S. goods further to 125%.

European Union

April: Tightened steel import restrictions, cutting quotas by 15%. Imports within quotas remain duty-free, but any excess faces a 25% tariff.

April 1: Reinstated retaliatory tariffs from 2018 and 2020 (originally imposed due to U.S. steel and aluminum tariffs), targeting U.S. exports like yachts, bourbon whiskey, and motorcycles.

Impact of the Trade War on Nations

China

Critical Metal Exports: Severely affected, with shipments of tellurium, tungsten rods, and other key metals to the U.S. plummeting in March. Some products, like molybdenum powder and bismuth, halted entirely.

Trade with Africa: Despite U.S. tariffs, China-Africa trade grew 2.7% YoY in Q1 2024, reaching $72.6 billion, thanks to long-standing partnerships and China’s duty-free policy for 33 least-developed nations.

Regional Cooperation: China is diversifying trade partners, including restarting trade talks with Japan and South Korea after five years—a milestone in regional economic integration.

RMB Internationalization: Expanding the Cross-Border Interbank Payment System (CIPS) to reduce reliance on the U.S. dollar and mitigate financial risks.

United States

Toy Retailers: Fear a Christmas sales crisis as Chinese toys face 145% tariffs; some have stopped imports entirely.

Consumers: 45% plan to cut non-essential spending, 33% will reduce essential purchases, and 30% aim to boost emergency savings.

Auto Industry: Six major auto groups pressured the Trump administration against new parts tariffs, warning of soaring production costs.

Tech Giants: Meta expects $7B in ad revenue losses, while Nvidia’s stock plunged due to export controls.

Medical Manufacturers: Divided—some seek exemptions for devices, while others (like PPE makers) benefit from tariffs.

Manufacturing Shift: Some firms eye relocating to Mexico/Canada for USMCA exemptions.

Retail: Amazon canceled some direct imports from China; sellers may pass costs to consumers.

Tariff Revenue: U.S. Customs has collected over 2B/day clashes with Treasury data (~$305M/day).

Other Regions

Southeast Asia: U.S. solar tariffs hit Cambodia, Malaysia, and Thailand, disrupting local industries.

Canada: Retaliated with tariffs and saw grassroots boycotts (e.g., Ontario liquor stores dropping U.S. products).

Poland: Urged stronger U.S.-EU defense ties to avoid trade clashes.

Russia: Indirectly affected by global trade disruptions.

EU:

EVs: Tense negotiations with China resumed after disputes.

Tech: Nvidia’s China business may shrink as local semiconductor demand rises.

South Korea: Pushing for a tariff-exemption deal by July.

Philippines: Less impacted but held back by weak infrastructure.

Vietnam & Thailand: High tariffs (paused until July) pressure exports.

Indonesia: Narrow exemptions and price-sensitive exports heighten risks.

Industry-Specific Fallout

Aerospace: RTX (500M loss) struggle with rising costs.

Luxury Goods: Hermès raised U.S. prices to offset tariffs.

Pharma: Eli Lilly and J&J resist tariffs, but industry views are split.

Shipping: COSCO faces higher port fees; Maersk and Hapag-Lloyd impose surcharges. DHL suspended high-value B2C shipments to the U.S.

Port Congestion: Backlogs in Germany, Italy, the Netherlands, and the U.K. due to labor strikes and overcrowding.

EVs: Chinese makers pivot to Russia/Middle East as U.S./EU tariffs bite.

Solar: Chinese firms reroute supply chains after U.S. tariffs on Southeast Asia.

Battery Storage: China’s sector suffers from oversupply and a 39% price drop (2020–2024).

Robotics: Some Chinese firms (e.g., a café-robot maker with 100 patents) remain unscathed.

Alcohol: U.S. spirits exports hit a record $2.4B (50% to EU), but steel/aluminum tariffs squeeze margins.

Semiconductors: Nvidia’s China sales slump as local chipmakers rise.

Stances and Strategies

China: Opposes U.S. tariffs, seeks multilateral talks, and boosts domestic innovation.

U.S.: Trump defends tariffs despite backlash (e.g., California’s lawsuit).

Multinationals: Some (like Toyota) double down on China; others adjust supply chains.

Experts: Warn tariffs may reshape global trade alliances, favoring China in the long run.

How Shengshi Group Can Help You

Amid the turbulent waves of global tariff wars, navigating international trade has become fraught with risks. High tariffs, shifting policies, and customs hurdles loom like storm clouds, leaving import/export businesses in uncertainty.

Summit Global Logistics—a U.S.-based customs brokerage with 50+ years of experience, 500+ trucks, and a bilingual team—stays ahead of policy shifts to offer:

Tariff Consulting: Real-time updates and cost forecasts to avoid budget overruns.

Customs Clearance: Leveraging strong relationships to expedite paperwork and minimize delays.

Risk Mitigation: Rigorous document checks to prevent hold-ups and reduce storage costs.

Choose us for peace of mind. In these challenging times, let our expertise guide your business through the storm, ensuring steady progress toward a brighter trade future.