![[sort:pic]](/template/default/images/banner/3-3.jpg)

Lean management provides customers with high-quality services and a visible panoramic view of the prosperous era.

Share

U.S. Customs Clearance | Why is a POA Sometimes Required for U.S. Customs Clearance?

Introduction: Must-read guide—save it for later!

When exporting goods to the U.S., customs clearance is mandatory before products can reach customers. If clearance fails, shipments may face delays or even confiscation.

This is where the POA (Power of Attorney) becomes critical—it determines whether your goods clear customs smoothly and is a key part of international trade. So, what exactly is a POA, and why is it necessary?

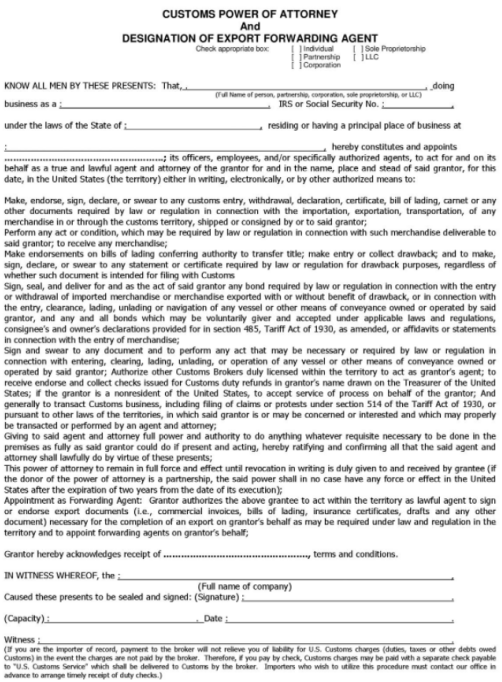

(Image source: Internet)

POA (Power of Attorney) is a client authorization letter required by U.S. Customs.

When shipping goods to the U.S., certain clearance fees must be covered by the shipper. To facilitate this, U.S. customs requires Chinese shippers to sign a POA before shipment—essentially an authorization letter similar to a customs declaration mandate.

Normally, the U.S. consignee (importer) must provide the POA to the customs broker.

For DDP (Delivered Duty Paid) shipments, there are two scenarios:

1.Using the Consignee’s Bond & POA

○ The U.S. consignee provides their Bond and POA to the freight forwarder’s U.S. agent.

○ Customs clearance and cargo pickup proceed under the consignee’s name.

2.Using the Shipper’s POA

○ The shipper signs the POA and clears customs in their own name.

○ The shipper provides the POA to their origin freight forwarder, who forwards it to the destination port agent.

○ The U.S. agent then registers an Importer of Record (IOR) number with U.S. Customs.

○ The shipper must also purchase a Bond.

Key Customs Clearance Notes

Regardless of the method, the U.S. consignee must provide a Tax ID (IRS No.) for clearance.

1. Tax ID (IRS No.) is mandatory—without it, clearance is impossible.

2. The IRS No. (Internal Revenue Service Number) is a tax identification number registered with the U.S. government.

3. No Bond + No Tax ID = No Clearance.

If your goods arrive at port and customs requests a POA, failure to provide one means:

● Customs holds your cargo, leading to storage fees and delays.

● Forced return shipments incur additional costs, harming your business.

Providing a POA isn’t just compliance—it ensures smooth customs processing and tax handling. If your goods need U.S. clearance, a professional team saves time, eliminates documentation stress, and boosts efficiency.

Shengshi Group’s team consists of experienced logistics experts and licensed customs brokers, offering nationwide U.S. coverage with overseas branches. Our commitment to integrity, innovation, excellence, and mutual success keeps us at the industry’s forefront.

Founded in 1973 in San Francisco, Shengshi Group is a full-service supply chain management provider for global cross-border sellers. Our U.S. services include:

✔ Full-port customs clearance

✔ 3PL warehouse distribution

✔ Overseas warehousing & transshipment

✔ Nationwide port drayage

As a leading U.S. customs broker, we offer:

● 50+ years of experience with a dedicated bilingual team.

● C-TPAT certification (since 2003).

● 4,900+ e-commerce sellers & 150+ Amazon vendors served.

● 10,000+ 40’ containers shipped monthly (2022).

Struggling with U.S. customs?

Shengshi Group makes clearance effortless!